First-time buyer

First-time buyer is a term normally associated with the residential property market. Very simply, describes people who are prospective purchasers of their first property, be that a flat or house.

Most, but certainly not all, first-time buyers are young people who have recently started their working life and are keen to get on the housing ladder. This can be a difficult process, given the problems associated with saving for a mortgage deposit, their limited funds and their potentially unestablished credit status. This is particularly so given the housing shortage and long term increase in house prices.

People are generally having to work longer to be able to save for a mortgage deposit. In 1960, the average age of a first-time buyer was 23, and they needed to save for two years to have £595 (around £12,738 today) available for a mortgage deposit.

In 2019, the average first-time buyer will be 30 or older and they will typically have to save for more than five years to have their required average mortgage deposit of £20,622.

Recent years have seen the introduction of various government and private-sector initiatives designed to help first-time buyers get onto the housing ladder. These include:

- Help-to-Buy schemes.

- Equity loans.

- Mortgage guarantees.

- Shared ownership.

- NewBuy.

NB English Housing Survey, Headline Report, 2020-21, published by the Department for Levelling Up, Housing and Communities in 2021, suggests: ‘First time buyers are defined as households that have purchased a property that is their main home in the last three years, and in which neither the HRP or partner have previously owned a property. It includes households who have purchased their property outright as well as those who are buying with the help of a mortgage or loan.’

[edit] Related articles on Designing Buildings

- Buy-to-let mortgage.

- Help to buy.

- Home ownership.

- Housing market.

- Housing shortage.

- National Planning Policy Framework.

- Owner.

- Rent to buy.

- Resident.

- Right to buy

- Right to rent

- Self build.

- Self build initiative.

- Shared equity / Partnership mortgage.

- Shared ownership.

- The rise of multiple property ownership in Britain.

- What is a mortgage?

Featured articles and news

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

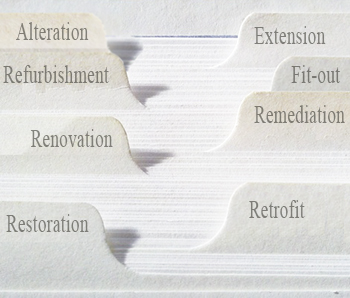

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.

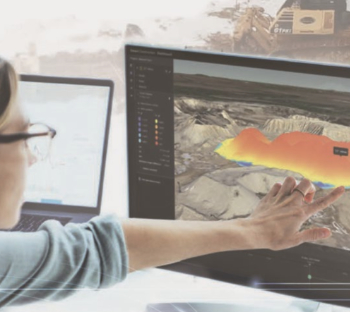

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure Bill

An outline of the bill with a mix of reactions on potential impacts from IHBC, CIEEM, CIC, ACE and EIC.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

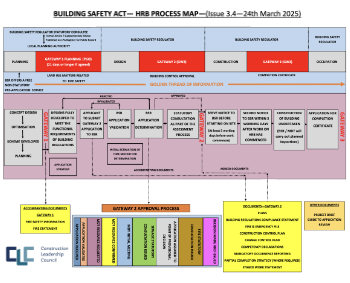

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.